Table Of Content

It’s a decision that carries financial implications that can impact your lifestyle and overall well-being. To help you make the right choice, consider all of your options and evaluate the pros and cons. You may also be responsible for homeowner association (HOA) fees, depending on the neighborhood you live in. And if home values decline, your resale value could be less than the original cost of the home.

Houses for Rent in Los Angeles, CA

So students who aren’t feeling safe in this protest environment don’t necessarily have to go to class. The problem with that is that, over the weekend, a series of images start to emerge from on campus and just off of it of some really troubling anti-Semitic episodes. In one case, a guy holds up a poster in the middle of campus and points it towards a group of Jewish students who are counter protesting.

What Is a 15-Year Fixed-Rate Mortgage?

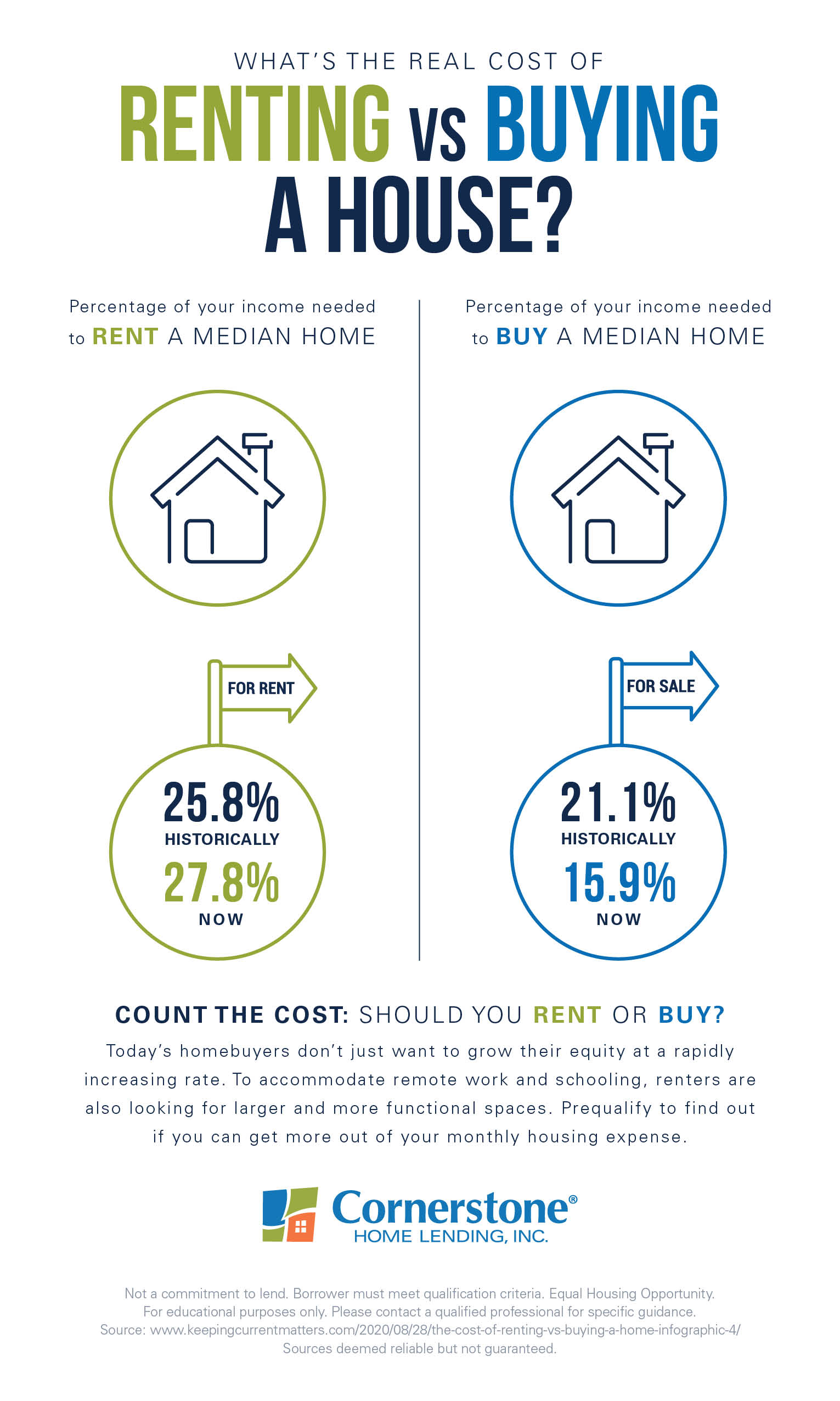

Everything discussed here plays into your final decision which can range from buy now to wait and rent to rent for life. Where you are right now may not be where you want to be in 3 to 5 years or more. If your time horizon is more than 5 years away, you may be safe buying since chances are it will be less expensive than renting over the same period. Below, we compare the first-year costs of renting vs. buying a home in Maryland. On the flipside, you’re limited in the changes you can make to the place you’re living in when you’re a renter.

Other financial benefits of buying a house

If you are committed to at least 3 to 5 years or more, it’s probably in your interest to look into buying. If you long to live elsewhere, lack job security, are not ready to stay in place for at least three years minimum, renting may make more sense for you right now. You don’t earn equity (or lose it) because you do not own the home or apartment where you live. Equity, or the increase in value a home receives over time, only goes to the person who owns the property. Owning a home affords you more privacy than a rental property would, especially if you are renting in an apartment complex or a house shared with the landlord.

Shop for a mortgage

Overall, prices in this category are 15.2 percent above the national average, and the best way to evaluate what you can and can’t do is to look at the individual price of your favorite activities. Are only slightly higher than the national average at 15 percent above. This is an increase of about 5 percent over the previous year. From routine check-ups to unforeseen trips to urgent care, healthcare costs are bound to pop up intermittently. If this works for you, you can save a lot on transportation costs, not to mention the time you’d have to sit in traffic otherwise. On both the bus and the train, a one-way trip costs $1.75.

Is it worth buying a house?

But they are now in league with a whole bunch of other universities that are struggling with the same set of questions. And it’s a set of questions that they’ve had since this war broke out. So Shafik’s dilemma here is pretty extraordinary. And for those students who maybe couldn’t go back to — into campus, now all of their peers, who were supporters or are in solidarity, are — in some sense, it’s further emboldened. They’re now not just sitting on the lawns for a pro-Palestinian cause, but also for the students, who have endured quite a lot. And it’s a university on top of all that that has a real history of activism dating back to the 1960s.

With high interest rates, is it better to rent or buy a home? - KSAT San Antonio

With high interest rates, is it better to rent or buy a home?.

Posted: Tue, 15 Aug 2023 07:00:00 GMT [source]

Things to Consider to Help You Make a Decision

Once you know more about owning a home vs. renting a home, then you can confidently move forward with your decision. If you are an owner, of course your equity is growing on an annual basis. People who are buying — even two years out, they can be making money. If they do decide to sell, after two or three years, they’re in a good position for equity growth in our market.” says May. Maybe you’re working toward buying a house or you’re brand-new to an area and you want to decipher what neighborhood best suits your needs. The temporary option of renting allows you to try out a different neighborhood if you’re not sure about your current one.

Sellers have also had to cool their heels — after all, they usually have to move somewhere else after selling, which comes with all the problems buyers are having. Despite the sometimes long and winding road to homeownership, having those keys in your hand is a pretty great feeling. You don’t have to go through a landlord to fix something in a timely manner or ask for permission to paint the walls, because the landlord is you. Another way to look at building equity is that it’s a type of forced savings account. It’s “forced” because you have to pay your mortgage every month, which in turn builds equity. One major perk of renting is that it allows flexibility, so you’re not confined to a neighborhood, a time frame, or a house you’re just not sure about yet.

Any improvements you make will benefit your landlord when you move out. When you rent, a landlord is responsible for managing the upkeep of the property and fixing any broken items or utilities. Renting is also a great option if you are not sure about putting down roots long-term yet. "Maybe you're exploring a new city or trying out how a new neighborhood feels," says Taylor. The real estate market is unpredictable, and a return on your investment, including everything you did to enhance the home, may not be the amount you were hoping for if the value of the home decreases.

People were often prevented from owning land because of their race, ethnic background, beliefs, or marital status in the past. Although practices like redlining (where people are denied services because of their race or ethnicity) continue to deter members of minority groups from seeking to own a home, they shouldn't. The borrower's ability to make payments is the only factor that mortgage lenders should consider. Homeowners may benefit from certain tax benefits. The home mortgage interest deduction reduces any out-of-pocket expenses during the early life of the loan, as long as deductions are itemized. The report says apartment living doesn’t mean renters are averse to the idea of community.

“If it’s a declining market where prices are going down, or where the market is very uncertain, renting might be the safer way to go,” says May. For all the commitment-phobes out there, the prospect of buying a house can be daunting. It’s a big investment, and usually it’s based on a 20- or 30-year mortgage contract, unless you plan on selling before it’s paid off — and that has its own set of challenges. Renting a home comes with a lot of flexibility and freedom that’s attractive to nomadic souls as well as those with savings that are slim to none.

After the break, what all of this has looked like to a student on Columbia’s campus. It basically boils down to this, she had just gone before Congress and told them, I’m going to get tough on these protests. So either she gets tough and risks inflaming tension on campus or she holds back and does nothing and her words before Congress immediately look hollow. They brought in outside consultants, crisis communicators, experts on anti-Semitism.

Unlike a fixed mortgage, the cost to rent is solely dependent on your landlord. If your landlord chooses to raise your rent, it could exceed your budget, forcing you to move out or risk eviction. A rent increase is when your landlord raises the rent you pay each month. Renting a home may be ideal in certain situations.

No comments:

Post a Comment